The Rule of seventy eight has its advantages and drawbacks. On one particular hand, it may be valuable for borrowers who system to maintain their loans for the whole time period, as they're going to shell out a lot less fascination Total as compared to other strategies. Then again, if you decide to repay your loan early, you might end up paying out far more fascination than you would with other calculation approaches.

Knowing how desire is calculated utilizing the Rule of seventy eight is essential for borrowers who intend to make educated choices regarding their loans. By grasping the mechanics of this calculation process and considering its positives and negatives, you'll be Geared up to choose the most fitted repayment approach to your money targets.

Comprehension the Rule of 78 is essential for borrowers, as it enables them for making educated selections with regards to their loan repayment approach. Borrowers who plan to repay their loans early must know about the probable money penalty connected with the Rule of 78. However, Individuals desiring to preserve their loans for the total expression could find the Rule of 78 beneficial regarding predictable desire payments.

We worth your have confidence in. Our mission is to provide readers with exact and unbiased information, and We have now editorial expectations set up to ensure that takes place. Our editors and reporters totally actuality-Test editorial content to make sure the knowledge you’re studying is correct.

belongings you can do for Your kids is have an open up discussion with them about the dangers and benefits of borrowing funds usually.

We keep a firewall involving our advertisers and our editorial staff. Our editorial group isn't going to receive immediate payment from our advertisers. Editorial Independence

Some establishments supply shorter or longer repayment periods As well as the typical 10-yr term, Extending your payment program is likely to scale back your month to month payment amount, but it's going to commonly also lead to better All round interest fees.

Your child can concentrate on get the job done, scholarships, or more info simply have a hole year to develop up some discounts to buy college. Consider our whole get of operations to pay for college.

4. Refinance Your Loan: Depending on your economic predicament and the conditions of one's loan, refinancing could be a viable choice. By refinancing, you could likely safe a reduced desire level, which is able to reduce your monthly payments and the overall fascination paid out.

DuxX/Shutterstock Bankrate is always editorially unbiased. Though we adhere to stringent editorial integrity , this article may perhaps incorporate references to goods from our associates.

Ideal IRA accountsBest on the internet brokers for tradingBest on the net brokers for beginnersBest robo-advisorsBest options trading brokers and platformsBest trading platforms for working day buying and selling

HELOC A HELOC can be a variable-price line of credit history that permits you to borrow funds for just a established interval and repay them afterwards.

Immediate Furthermore Loans come with little or no personal debt counseling and doesn't bear in mind the amount income it’s affordable for somebody to tackle with their financial debt and credit score.

But Take into account that Even when you're in a position to defer payments Whilst you're little one is pursuing their diploma, fascination will continue on to accrue each and every month on the principal equilibrium.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Christina Ricci Then & Now!

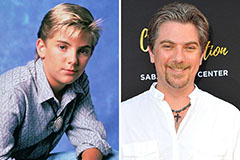

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!